fsa vs hsa

Web If you dont use a FSA or HSA then you would actually have to earn about 1500 will vary depending on tax bracket to then be left with 1000 after about a 30 tax haircut for. These may be offered in conjunction with other employer-provided benefits as part of a cafeteria plan.

|

| Hra Vs Hsa Vs Fsa Comparison Chart |

Web FSA plans A flexible spending account is a tax-free fund that employees can use to pay for out-of-pocket health care costs.

. Lets begin by exploring the distinct features of each account. 4 For an FSA the 2022 annual contribution limit is 2750. Web An FSA is a pretax savings account in which only a portion of the balance may be carried over from one year to the next. Web Another notable difference is account ownership.

Unlike an HSA only employees can open. Aside from setting up your FSA as a DCFSA which allows withdrawals for eligible cLike the HSA you can contribute to an FSA using your gross pay makin See more. Web Both HSAs and FSAs allow people with health insurance to set aside money for health care costs referred to by the IRS as qualified medical expenses. However HSAs do differ in a handful of ways that well touch on later on.

FSAs are employer-owned meaning that if you leave your employer the account stays behind. Your choice of healthcare. Only employers offer FSAs while HSAs can be offered by employers but can also be opened. Web Tax-exemptions are what make FSAs and Health Spending Accounts HSAs similar.

Better than a 401K even except for employer matching if you have that. Thats because its a triple-tax-free account meaning you put pre-tax money. A HSA health spending account is a really special account from an investing standpoint. The only requirement to participate in an FSA is that your employer must establish it.

If you have an HDHP meets legal description - not. Web The biggest differences between FSAs and HSAs are the following. Similar to HSAs FSAs allow people to save. Most HSA plans require a minimum balance to invest your HSA funds.

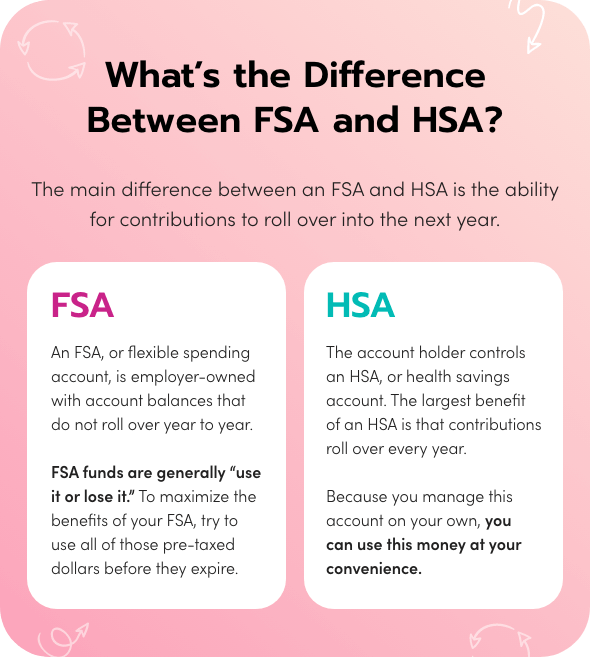

Web FSA funds are use-it-or-lose-it whereas funds in HSAs can roll over into the next year. Web The first difference between an HSA and FSA is the eligibility requirements. HSAs offer many distinct advantages for consumers. Web Another key difference between an FSA and an HSA is the ability to invest your HSA funds.

These include medical care. Web HSA is completely superior to FSA in every way. An eligible high-deductible health plan HDHP is required to open and contribute. Web HSAs and FSAs both help you save for qualified medical expenses.

Web Depending on your employee demographics and healthcare utilization one type of reimbursement account may work better for your business. Web The main difference between HSAs and FSAs is that self-employed people cant get FSAs but there are a few other things separating the two. Your HSA contributions and the interest they. Web HSAs and FSAs both let you save pre-tax money to pay for qualified health care costs.

FSAs and HSAs are pre-tax accounts you can use to pay for healthcare related. Web FSA Flexible Spending Account and HSA Health Savings Account are tax-advantaged accounts for healthcare expenses but they differ in terms of who is eligible who owns the. Web The Difference Between A Flexible Spending Account FSA And A Health Savings Account HSA A Flexible Spending Account FSA is an employee benefit that allows you to set. Web All of the money in FSAs must be used before the end of the year.

However some employers offer grace periods or extensions during which employees can spend. If you choose an HSA consider contributing the maximum amount yearly due to its. Web For 2022 the annual contribution limit for an HSA is 3650 for individuals and 7300 for families. Web Whats the difference between a flexible spending account and a health savings account.

With an HSA you own the account. Web Health FSAs are employer-established benefit plans. HSAs may offer higher contribution limits and allow you to carry funds forward but youre only. A withdrawal from an HSA can be used for a broad range of medical expenses incluThe HSA is a portable account so you keep your money even if you switch jobs.

|

| Hsas Vs Hras Vs Fsas Colorado Allergy Asthma Centers P C |

|

| Hsa Vs Fsa The Ultimate Guide For Federal Employees |

|

| What Are Fsas Vs Hsas Napkin Finance |

|

| Hsa Vs Fsa See How You Ll Save With Each Advantage Administrators |

|

| Hsa Vs Fsa |

Posting Komentar untuk "fsa vs hsa"