w4 2022 pdf

Enter a term in the Find box. Last name Address.

|

| W4 Form 2022 Pdf Download 2022 W4 Form |

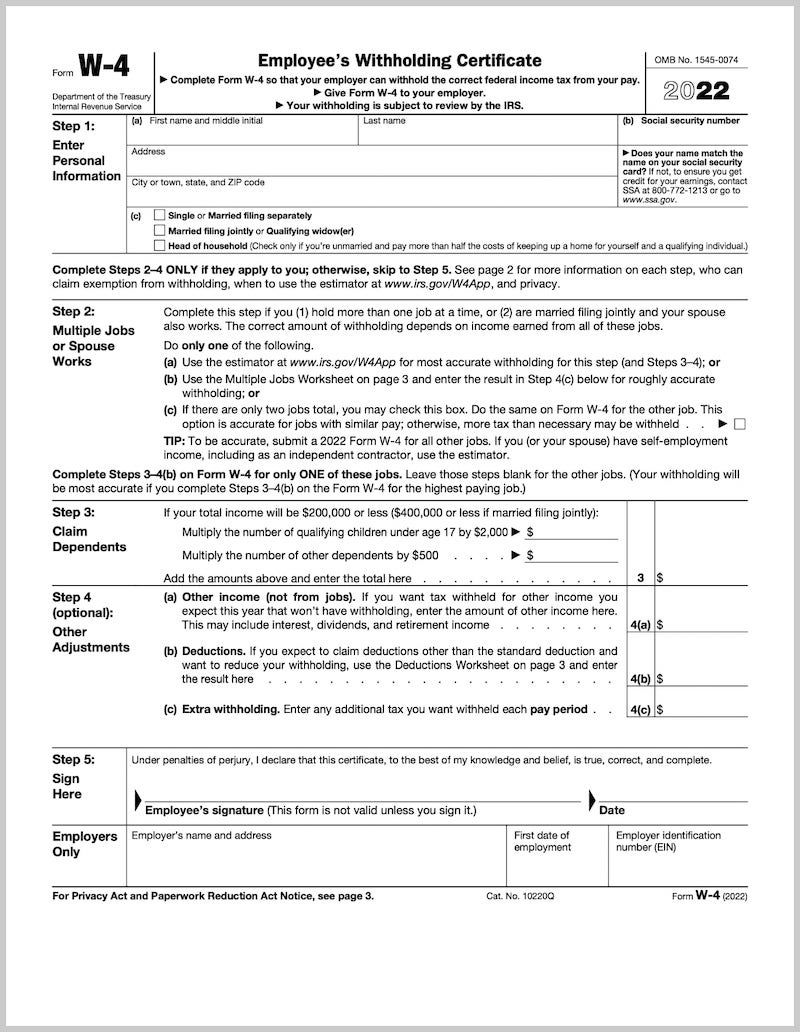

Unless changes are required employees who have submitted a W-4 anytime before 2022 are not required to submit a new form.

. Last name Address. January 2022 Step 1. City or town state and ZIP code. 2022 Withholding Certificate for Periodic Pension or Annuity Payments Department of the Treasury Internal Revenue Service Give Form W-4P to the payer of your pension or annuity payments.

1221 Effective January1 2022 Employee Instructions Read the instructions on Page 2 before completing this form. View more information about Using IRS Forms Instructions Publications and Other Item Files. See Informational Publication 20221 Connecticut Employers Tax Guide Circular CT for complete instructions. We collect a state.

Click on the product number in each row to viewdownload. First name and middle initial. You may be able to enter. Government of the District of Columbia.

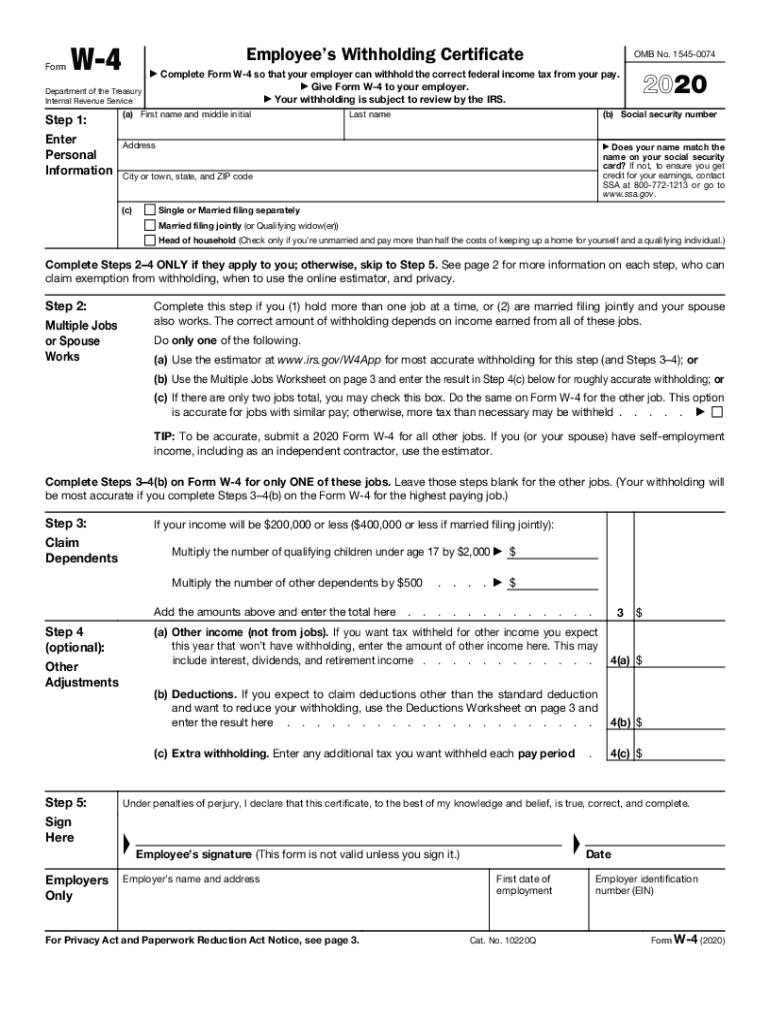

Employers will compute withholding based on information from the employees most recently submitted W-4. Select a category column heading in the drop down. Click the Search button. Fillable Form W-4 2022 The Form W-4 is an Internal Revenue Service tax form completed by an employee in the United States to indicate his or her tax situation to the employer.

2022 Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions Department of the Treasury Internal Revenue Service Give Form W-4R to the payer of your retirement payments. Information about Form W-4 Employees Withholding Certificate including recent updates related forms and instructions on how to file. A Enter 1 for yourself a. Forms and Instructions PDF Enter a term in the Find Box.

Employees Withholding Exemption Certificate and. 1b Social security number. The W-4 form tells the employer the correct amount of federal tax to withhold from an employees paycheck. Click on column heading to sort the list.

W4 2022 PDFpdf - Google Drive. For any employee who does not complete Form CT-W4 you are required to withhold at the highest marginal rate of 699 without allowance for exemption. All 2022 new hires must complete a W-4 and some states have released new withholding forms. Select the filing status you expect to report on your Connecticut income tax return.

Enter Personal Information a First name and middle initial. You are required to keep Form CTW4 in your files for each employee. Request for Federal Income Tax Withholding from Sick Pay. The latest versions of IRS forms instructions and publications.

City or town state and ZIP code. Withholding Certificate for Retirement Payments Other Than Pensions or Annuities. D-4 DC Withholding AllowanceWorksheet. 2022 Sales Use and Withholding MonthlyQuarterly and Amended MonthlyQuarterly Worksheet.

Click on a column heading to sort the list by the contents of that column. 2022 Sales Use and Withholding 4 and 6 MonthlyQuarterly and Amended MonthlyQuarterly Worksheet. Form W-4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay. Section A Number of withholding allowances.

Form CT-W4 Employees Withholding Certificate Department of Revenue Services State of Connecticut Rev.

|

| How To Fill Out 2021 2022 Irs Form W 4 Pdf Expert |

|

| W4 Form 2022 |

|

| W4 Form 2022 Withholding Adjustment W 4 Forms Taxuni |

|

| Irs Form W 4 Free Download |

|

| Irs W 4 2020 2022 Fill And Sign Printable Template Online Us Legal Forms |

Posting Komentar untuk "w4 2022 pdf"